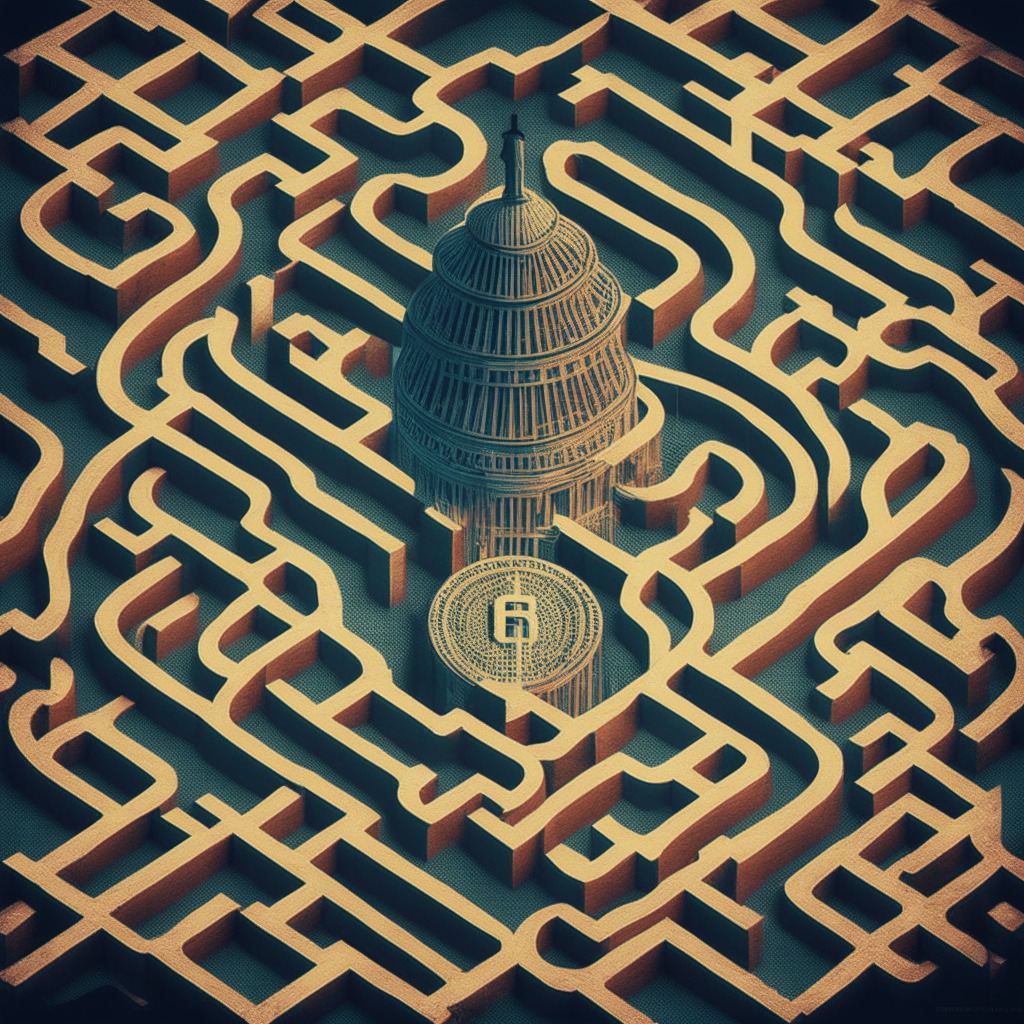

Last month witnessed crucial decisions by the House Financial Services Committee and Agriculture Committee on the Financial Innovation and Technology for the 21st Century Act (FIT Act). This notable event commenced a promising era in the digital assets industry. The FIT Act, while not yet impeccable, marks the premiere of crypto-focused legislative efforts gaining traction in the House and Senate.

The Blockchain Association’s CEO, Kristin Smith, represents more than a hundred preeminent industry players. Positively, the FIT Act has rallied integral bipartisan support, highlighting a mutual agreement about the significance of this sector, which isn’t to be overlooked by the current status quo regulatory regime. Policymakers sent out an unequivocal message last month; crypto is here for good, and it’s Congress’s role to establish a suitable regulatory milieu for the industry, rather than leaving it at the mercy of regulators.

A tide shift is visible among lawmakers, moving towards the development of sagacious regulations that assure consumer protection while fostering innovation. The gravity of the cryptocurrency industry, its resistance to partisan whim, and a determination for a coordinated approach has been well established. The recurrent lamentations about the inadequacy of the existing regulatory system—and the associated vehement SEC enforcement—are suggestive of an active effort to reevaluate the current framework.

Simultaneously, the crypto industry has varied tumultuous journeys to its credit, from the collapse of Do Kwon’s algorithmic stablecoin to the implosion of FTX, orchestrated by Sam Bankman-Fried. These incidents have tarnished the industry’s reputation. However, the ripple effect in Congress has largely been one of growing cognizance that the digital asset industry is here to stay, and no wishful thinking can render it obsolete.

While digital assets and blockchain technologies continue their steady rise, simultaneously posing an existential challenge to traditional financial systems, the onus falls on the regulators to contrive adroit, prophetic rules that boost innovation while maintaining consumer protection.

The innovative potential of digital assets and crypto networks run far deeper than speculative facets. As internet recast the sphere of information, cryptocurrency is revolutionizing the notion of value, bringing forth transformative benefits. The FIT Act signifies a monumental stride, recognizing the weight of the digital assets industry.

Yet, much work awaits ahead. The eminent congressional recess is slated to be a crucial phase for refining the bill and steering the future of industry-specific policymaking. A joint effort from industry stakeholders, regulators, and lawmakers is requisite to address potential imperfections, ambiguities, and regulatory voids. The process aims at an exhaustive framework that promotes innovation while ensuring market integrity and consumer protection.

Institutions like Blockchain Association stay poised to serve as resourceful inputs in this collaboration between the industry and policymakers. The collective sapience and insights of both parties are crucial for future legislation, to coherently accommodate the shifting dimensions of the digital asset arena and entrench the US as the global leader in innovation.

Source: Coindesk