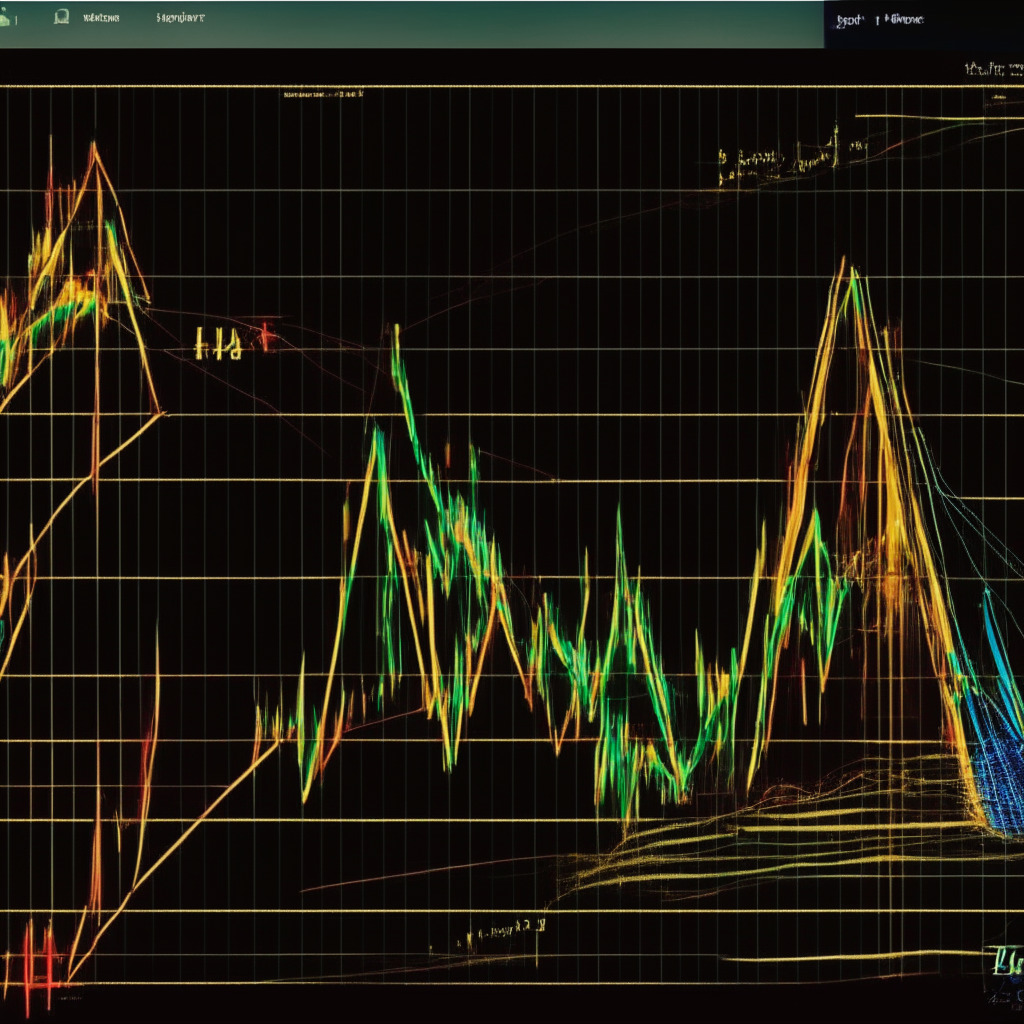

The Bitcoin price has experienced a significant upwards momentum in recent days, as evidenced by a series of four consecutive green candles observed on the daily chart. This positive trend may be related to the formation of a double bottom pattern, which often results in considerable price recovery once the resistance trendline is broken. Therefore, the rising Bitcoin price will soon test the $27,500 level, answering the question of whether buyers can maintain these higher levels.

This positive price action comes as Bitcoin bounces off the $26,000 psychological support level in an effort to end the ongoing consolidation on a bullish note. If the breakout above the $27,500 barrier occurs, it could strengthen buyers for a swift 3% jump. However, the market has experienced a 12.5% loss in intraday trading volume, which holds at $5.68 billion.

Currently trading at $27,293 with an intraday gain of 1.3%, Bitcoin is forming a double bottom pattern that could potentially push the price higher to break the immediate resistance of $27,500. Successfully flipping this barrier would provide buyers with a solid foundation to continue the bullish upswing. Nevertheless, the potential rally may encounter a significant obstacle at the $28,000 level, as it coincides with the downsloping trendline.

Investors should carefully monitor the price behavior at this trendline, as it will considerably influence the coin’s future trajectory. A decisive daily candlestick closing above the trendline would offer better confirmation of a fresh recovery rally. In response to the double bottom pattern formation, the Bitcoin price could see growth in underlying bullish momentum and breach the $27,500 barrier, ensuring the buying pressure remains intact and potentially driving the price to the $28,000 level in the near future.

Technical indicators also point to potential bullish price action. A potential breakout from the $27,500 barrier would challenge the upper band of the Bollinger Band indicator, presenting traders with a momentum trading opportunity. Additionally, a bullish crossover between the Moving Average Convergence Divergence (MACD) and the signal line could signify a trend reversal.

While there are promising signs for Bitcoin’s price, it’s crucial to remember that the presented content represents the personal opinion of the author and is subject to market conditions. Ensure thorough market research is conducted before investing in cryptocurrencies, as neither the author nor the publication holds any responsibility for personal financial loss.

Source: Coingape