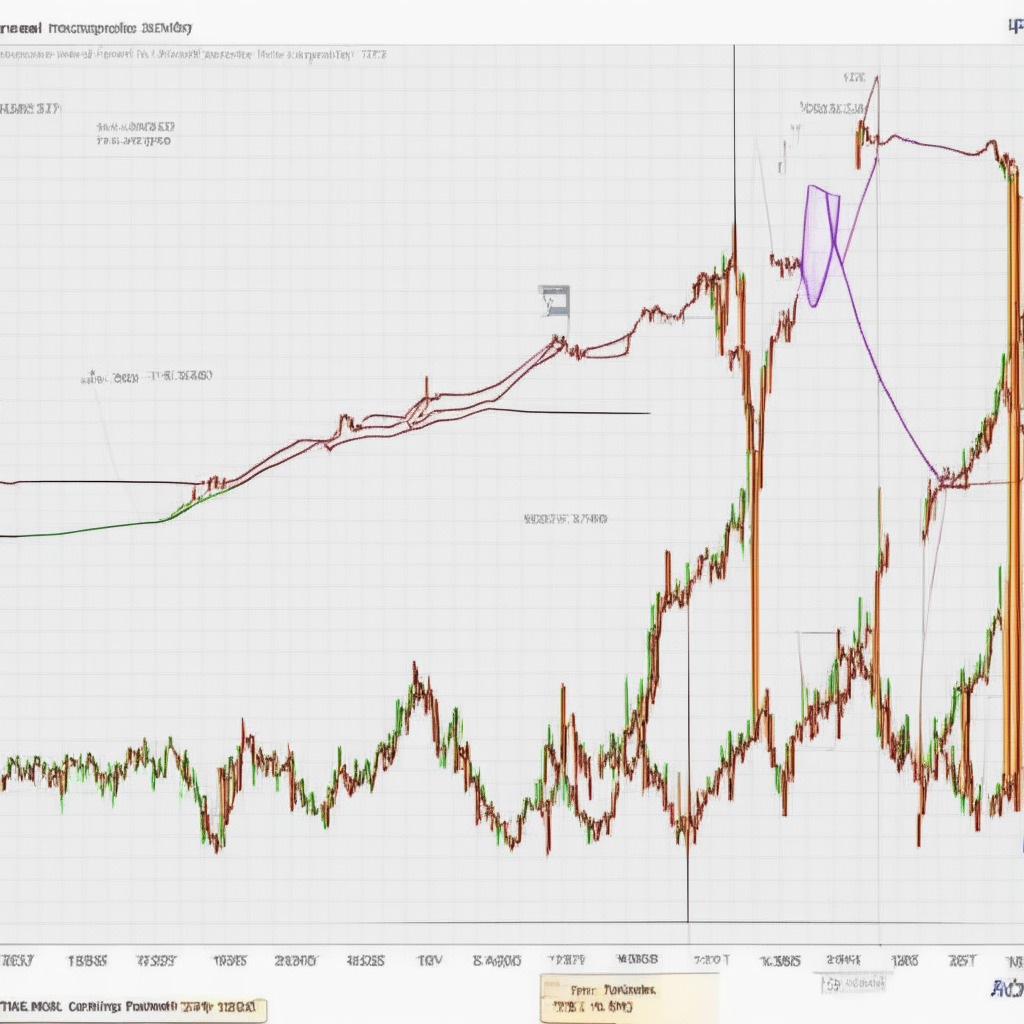

As Genevieve Roch-Decter, CFA, highlights, US bank deposits are on the brink of slipping under $17 trillion for the first time in over 2 years. This decline could signal that individuals are shifting their funds away from traditional banking institutions and towards cryptocurrencies such as Bitcoin. But is this potential shift due solely to the recent bank failures, or are deeper economic forces at play?

In 2023, noteworthy banks including Silicon Valley Bank, Silvergate Bank, Signature Bank, and First Republic Bank all collapsed, leaving many depositors scrambling for access to their funds. One factor in these collapses was the significant investment in Treasury and mortgage bonds by some of the banks, which lost value when interest rates climbed. The ensuing panic forced many depositors, especially tech startup founders, to make hasty withdrawals.

Similarly, Signature Bank and First Republic Bank faced difficulties due to high volumes of uninsured deposits and wealthy customers exceeding the FDIC-insured limits. But while these bank failures are substantial, it’s crucial to consider the impact of broader economic forces, such as inflation, mistrust, and recession.

Inflation has been a persistent concern for the US economy, with prices rising 4.9% in the year leading up to April. While slightly down from March’s 5%, this still highlights the tenth consecutive month of slower price increases. To address inflation, the Federal Reserve has enacted significant interest rate hikes, which have tempered price increases but also negatively affected bank deposits.

As interest rates rise, individuals search for alternative investment opportunities, such as cryptocurrencies like Bitcoin. Often lauded as a potential hedge against inflation with its finite supply and decentralized nature, Bitcoin might entice investors seeking a store of value during high-inflation periods.

However, the outlook on Bitcoin is far from unanimous. While some perceive it as a secure safe-haven asset, others are skeptical and view it as a highly speculative and risky investment. It remains crucial for investors to conduct thorough market research before committing to cryptocurrency investments.

In conclusion, both the spate of bank failures and broader economic forces have contributed to the decline in US bank deposits. While cryptocurrencies may prove to be an enticing alternative for some, it is crucial for investors to approach these assets cautiously and perform their due diligence to mitigate financial loss. The author and the publication bear no responsibility for personal financial losses incurred in cryptocurrency investments.

Source: Coingape