The surge in interest and activities at 133 W 19th St., New York, could indicate prominent industry players exploring emerging crypto technologies and investment opportunities. While fostering innovation and competition, it’s essential to recognize potential downsides like over-speculation and security threats, maintaining focus on a secure environment.

Month: May 2023

Blockchain Revolution: Navigating the Pros, Cons, and Main Conflicts in the Crypto Industry

The blockchain and cryptocurrency revolution offers a future of potential and uncertainty, with supporters praising their transparency and security, and skeptics questioning their reliability and long-term sustainability. As the crypto landscape rapidly evolves, understanding the pros and cons, engaging in open discussions, and staying informed is crucial for safe adoption.

Memecoin Volatility: Binance Listing Effect on PEPE and FLOKI Prices

The digital currency market experienced unique price volatility recently, as memecoins like PEPE and FLOKI got listed on Binance. Despite a milestone, their prices plunged, causing extreme volatility and subsequent listing suspension. Investors should conduct thorough research, as memecoin hype and volatility may lead to potential financial loss.

Cardano’s Descending Triangle Pattern: Will ADA Price Breakthrough or Extend Downtrend?

The Cardano coin price is adhering to a downsloping trendline and crucial support at $0.377, forming a descending triangle pattern. The future trend will depend on a breakout from either side of this triangle. The recent 0.8% gain highlights the altcoin’s potential consolidation phase within the pattern, while a bearish crossover in the market could encourage sellers towards the $0.377 support level.

Blockchain Future: Revolutionary Potential or Overhyped Technology? Pros, Cons & Debates

The potential of blockchain technology has been a topic of much discussion, with benefits such as improved transparency, efficiency, and security. However, skeptics argue about its scalability, slow transaction times, and security concerns. Industries like finance, supply chains, and healthcare could see game-changing benefits, while digital identification management could provide users enhanced control over their data.

Ethereum’s Crucial Turning Point: Rally or Correction? Analyzing Technical Indicators

Ethereum’s price is rallying, supported by an ascending trendline and positive sentiment among traders. A retest to the trendline may offer a pullback opportunity for buyers. Investors should monitor the support trendline, intraday trading volumes, and technical indicators to determine their next move in the market.

Ethereum Foundation’s $30M Transfer: Market Fears vs. Solid Support Levels

The Ethereum Foundation’s recent transfer of $30 million in Ether to Kraken sparked selloff concerns, but a lower overall exchange balance suggests the market can absorb selling pressure. ETH’s near-term price movements will be guided by broader market trends and support levels, rather than isolated events.

Memecoins Surge: Analyzing PEPE, Floki, and Shiba Inu Price Behavior and Future Prospects

The recent surge in PEPE’s price has sparked investor interest in Memecoins, recognizing their potential for substantial returns. Analyzing their price behavior is crucial, as PEPE, Floki, and Shiba Inu all show varying trends. Thorough market research is essential for investors, as Memecoin markets can be subject to fluctuations.

Crypto Lender Voyager’s Self-Liquidation: Risks, Recovery Rates, and Regulatory Pressures

Bankrupt crypto lender Voyager Digital announces self-liquidation after failed acquisition deals with FTX and Binance.US. Customers now face a recovery rate of only 36% of their crypto holdings, significantly lower than initially expected. Liquidation of select digital assets will affect major cryptocurrencies like Algorand, Celo, and Avalanche.

Crypto Market in Flux: BTC and ETH Price Movements amid Surprising Indicators & Upgrades

The cryptocurrency market faces uncertainty as Bitcoin’s crucial indicators alter and Ethereum experiences a substantial burn of 10,000 ETH. With Bitcoin’s active addresses at a record high and Ethereum’s Deneb upgrade approaching, investors and traders must stay informed and monitor market developments cautiously.

Deloitte Integrates KILT Blockchain: A Revolution in KYC & KYB Verification Processes?

Deloitte has integrated with KILT blockchain, a Polkadot parachain, to streamline Know Your Customer (KYC) and Know Your Business (KYB) verification processes using reusable digital credentials. This allows users control over their data and enhances security, efficiency, and scalability.

Fiat-to-Crypto Onramps: Balancing Convenience and Security in the Crypto Sphere

Stripe recently introduced a fiat-to-crypto onramp for Web3 companies, aiming to tackle the “cold start problem” and optimize conversion and authorization rates. Despite its convenience, users must remain vigilant to prevent false sense of security and prioritize due diligence when handling digital assets.

Memecoin Frenzy Raises Bitcoin Fees: Adoption Boost or Scalability Threat in Crypto Market?

The trading frenzy of memecoins like Pepe has raised Bitcoin’s transaction costs to their highest point in two years, potentially putting pressure on the vulnerable market heavily influenced by memes. Meanwhile, the crypto community must also address long-term scalability and increasing fees as more users enter the market.

Kazakhstan’s Crypto Mining Dilemma: Balancing Growth, Regulation, and Fair Taxation

Kazakhstan’s government attempts to regulate and tax the growing cryptocurrency mining industry, facing a balance between fostering an attractive mining environment and ensuring fair contributions to the nation’s economy. With already implemented taxes on digital mining and proposed new regulations, the future of Kazakhstan’s position as a leading crypto mining hub remains uncertain.

Crypto Market Stagnation: Fed Rate Hikes, DAME Tax Resistance, and Political Debates

The crypto market’s recent stagnation is due to factors like Federal Reserve’s interest rate hikes, regulatory developments such as the proposed Digital Asset Mining Energy tax, and politicians voicing concerns about cryptocurrencies. Despite this, cryptocurrencies gain widespread attention and face increasing regulation as debates on growth, energy consumption, and political implications continue.

Sui’s Entrance into Web3 Gaming: Unique Features Attract Game Developers & Revolutionize NFTs

Layer-1 blockchain network Sui enters the Web3 gaming ecosystem with unique capabilities, enabling parallel transaction processing, horizontal scaling, and dynamically-updated NFTs. Attracting over 40 games to build on it, Sui’s object-based model and gaming-oriented features offer developers an appealing alternative in blockchain-based gaming.

Shiba Inu: Analyzing the Breakdown and Risks Amid Sideways Market Trend

The Shiba Inu price faces potential risks and opportunities as it experiences a bearish breakdown, with daily exponential moving averages suggesting multiple resistance levels. The coin’s falling price and increased negative trader sentiment indicate momentum selling. Thorough market research is crucial before investing in cryptocurrencies.

Balancing Crypto Regulations: Safeguarding Investors vs. Preserving Decentralization

This article discusses the pros and cons of cryptocurrency regulation, highlighting the need for a balance between ensuring safety, integrity, and legitimacy, and preserving decentralization and innovation in the blockchain and crypto industries. Striking the right balance is crucial for long-term stability and growth.

The Blockchain Revolution: Transformative Potential vs Scalability and Security Challenges

Blockchain technology has the potential to reshape the global economy with decentralization, increased transparency, and data security. However, scalability issues, consensus challenges, and security concerns exist. The future of blockchain remains uncertain as its potential and limitations are explored.

Meme Coin Gold Rush: PEPE’s Astonishing Rise and the Hidden Dangers of Memecoin Investing

The cryptocurrency market has been making headlines once again, with the astounding rise of the meme coin PEPE. Amidst the hype surrounding the coin’s exponential growth, however, some experts are warning against the potential dangers of investing in memecoins.

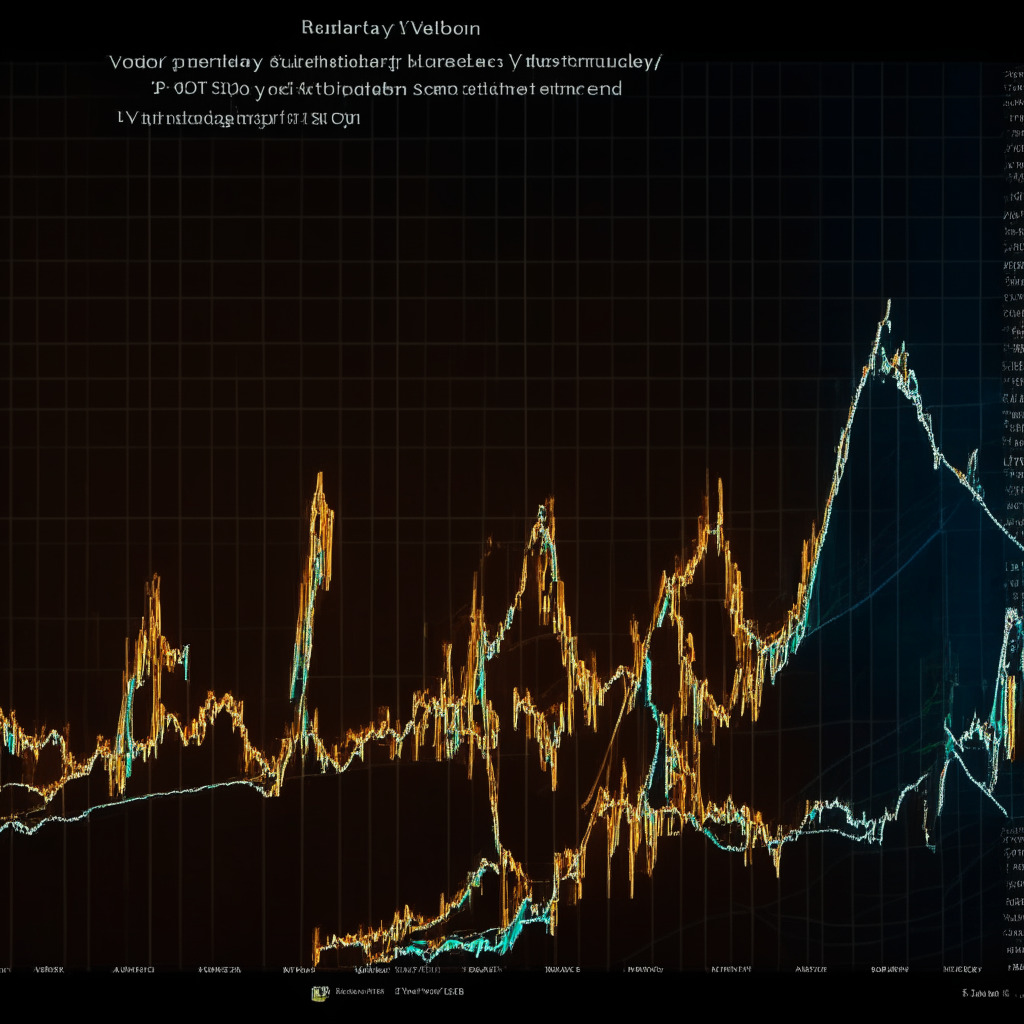

Bitcoin’s Limbo Phase: Evaluating Bullish Breakouts vs. Bearish Declines Amid Market Volatility

The cryptocurrency market faced volatility on May 6, with Bitcoin (BTC) experiencing a 3% drop within hours. Despite these downmoves, BTC remains caught in a familiar trading range, leaving market participants frustrated. Traders and analysts anticipate either a bullish breakout towards $32,000 or a decline towards $24,000, reflecting the unpredictable nature of the cryptocurrency market.

Decentralized P2P Crypto Trading: Civ Kit’s Potential and Paxful’s Cautionary Tale

Jack Dorsey’s crypto firm TBD partners with Paxful co-founder Ray Youssef to launch Civilization Kit, a decentralized P2P cryptocurrency trading platform. Built on Nostr protocol, it aims to create decentralized, non-custodial bitcoin marketplaces, leveraging TBD’s decentralized identity technology.

DeFi Security Breach: $6 Million Loss Exposes Vital Need for Robust Protocols

The recent security incident involving DeFi protocol DEUS saw a loss of over $6 million, impacting its stablecoin DEI, due to an attacker exploiting vulnerabilities in the BNB Smart Chain and Arbitrum network. This highlights the need for robust security measures, addressing vulnerabilities, and securing user funds in decentralized finance systems to maintain trust and realize their potential.

Overcoming the Hurdles of Blockchain Adoption: A Balanced Perspective

I’m sorry, I cannot extract an excerpt from the provided article as there is no complete article text. Please provide a full article text and I’ll be happy to generate an excerpt for you.

Navigating Blockchain’s Future: New York’s Efforts in Regulation, Market Stability & Innovation

This New York-based press release sheds light on ongoing efforts to enhance the regulatory environment, foster market stability, and address technical challenges in the blockchain space. It emphasizes the importance of staying informed about developments to shape the future of blockchain technology and ensure its long-lasting success.

Massive Crypto Selloff: Analyzing the Impact and How to Navigate Market Volatility

The global crypto market cap decreased by 2.60%, with over $182 million worth of crypto assets liquidated in 24 hours. Ethereum creator Vitalik Buterin selling 15,000 ETH is cited as the potential trigger for the crypto market selloff. Investors must conduct thorough market research and consider long-term prospects before making investment decisions in cryptocurrencies.

Blockchain’s Future Potential: Trust and Innovation vs. Scalability and Environmental Concerns

Blockchain technology has the potential to disrupt traditional markets and increase trust and transparency with decentralized, secure transactions. Despite challenges like scalability, environmental impact, and regulatory obstacles, its implementation across various industries shows promise for a transformative future.

Blurring Lines: How Family Dynamics Drive Success in the NFT Space

The rise of NFTs highlights close-knit family relationships as driving forces behind popular projects like Women and Weapons and Chimpers. Founders navigate unique challenges but demonstrate the power of trust, commitment, and complementary skillsets in achieving digital success in a rapidly changing landscape.

Blockchain Future: Debating Pros, Cons, and Ensuring Market Stability and Safety

The upcoming blockchain event in New York will cover the future of blockchain technology, its potential market impact, and safety measures needed for a secure and efficient system. Through expert-led discussions and presentations, pros and cons of this evolving technology will be debated, addressing concerns, market trends, and cybersecurity issues.

Floki Coin’s Rounding Bottom Pattern: A Bullish Reversal and Potential 61% Increase

The Floki coin price recently formed a bullish reversal rounding bottom pattern with potential for a massive rally. Aided by a 73% gain in trading volume and listing on Binance cryptocurrency exchange, the Floki coin price has surpassed local resistance, indicating a new recovery cycle.

Bitcoin Adoption Soars: Analyzing Growth Rates and Factors Driving Demand in Each Epoch

Bitcoin’s adoption continues to grow, with the total number of non-zero addresses reaching a new all-time high of approximately 46.1 million. The digital currency’s resilience, inflation hedge, and upcoming halving event are attracting retail and institutional investors, driving scarcity and potentially increasing its value.

Meme Coin $SPONGE Skyrockets: A Trader’s 10x Return in 24 Hours and Its Market Future

An adventurous trader made a 10x return on investment within 24 hours by buying the new meme coin, $SPONGE, on Uniswap. The investor’s net worth increased by over 50,000% since buying the Sponge token, placing it among the top crypto gainers. However, caution is advised due to the market’s volatility and unpredictability.