XRP price faces uncertainty, oscillating below the $0.55 resistance mark with no clear buyer or seller dominance. A decisive breakout above this resistance or breakdown below $0.486 will signal the future price direction. Meanwhile, technical indicators like MACD and EMA offer further market insight.

Search Results for: Crossover Markets

Bitcoin Bearish Reversal: Prospects of Recovery Rally or Further Downtrend?

The Bitcoin price recently experienced a bearish reversal, with a 5% decline over the week. A breakdown below the $26,500 support level may trigger further drops. Technical indicators, including MACD and EMA, confirm the potential for a downtrend continuation. Caution and research are advised before entering the market.

Bitcoin’s Correction Phase: Analyzing Risk, Crucial Demand Zones, and Future Trajectory

On May 29th, Bitcoin’s price demonstrated its third bearish reversal, causing a 4.6% decline in its market value and bringing its price down to $27,201. While the overall market trend remains bullish, a potential drop to $25,000 or $24,000 may mark the end of its correction phase. Buyers should watch for a breakout to restore bullish momentum.

Descending Triangle Pattern in Terra Classic – A Looming 15% Drop or Reversal?

Terra Classic’s LUNC price shows signs of a potential downtrend continuation with the formation of a descending triangle pattern. Market participants should monitor this bearish pattern and be prepared for a possible breakdown or breakout impacting the coin’s price significantly.

Ethereum Price Recovery: Analyzing the Wedge Pattern Breakout and Market Sentiment Shift

Amid the recent crypto market sell-off, Ethereum price witnessed a minor pullback that retested the breached trendline of the wedge pattern, signaling an early sign of the end of the correction phase. The wedge pattern breakout indicates a potential recovery rally with a target of $2000, as the market sentiment shifts from selling to buying. However, investors should remain cautious and monitor factors driving the Ethereum price.

Cardano Price Decline: Analyzing Support Trendline and Predicting Future Recovery

Cardano price experiences a 1.22% decline as it approaches the support trendline of the rising channel pattern. Despite selling pressure, the overall bullish trend remains intact. Experts predict a potential reversal, bouncing off support and regaining momentum, with targets of $0.42, $0.46, and $0.5.

Bitcoin Price Analysis: Bearish Channel Pattern vs Bullish Indicators – What to Expect?

The crypto market’s recent buying pressure, linked to the US debt ceiling deal, led to a Bitcoin price surge. However, current short-term trends show bearish sentiment and potential downfall. As market conditions vary, investors must conduct thorough research and be prepared for uncertain price movements.

Cardano Price Recovery: Analyzing a Potential Surge to $0.5 Amid Market Uncertainty

The Cardano price experienced a bullish reversal within the channel pattern, and a breakout above the $0.378 barrier could continue its recovery rally. As buying momentum persists, the reversal may push prices towards the $0.5 mark, but investors should remain cautious of resistance levels and market conditions to ensure sustainable long positions.

Ethereum Breakout Signals Potential Trend Reversal: Analyzing Market Conditions & Resistance Levels

Ethereum recently experienced a price breakout on May 28th, signaling a potential trend reversal. With a high volume of buyers, Ethereum’s market value could climb 12.2% to hit $2132. However, investors must vigilantly observe market conditions as resistance levels remain crucial to maximize success in the volatile market.

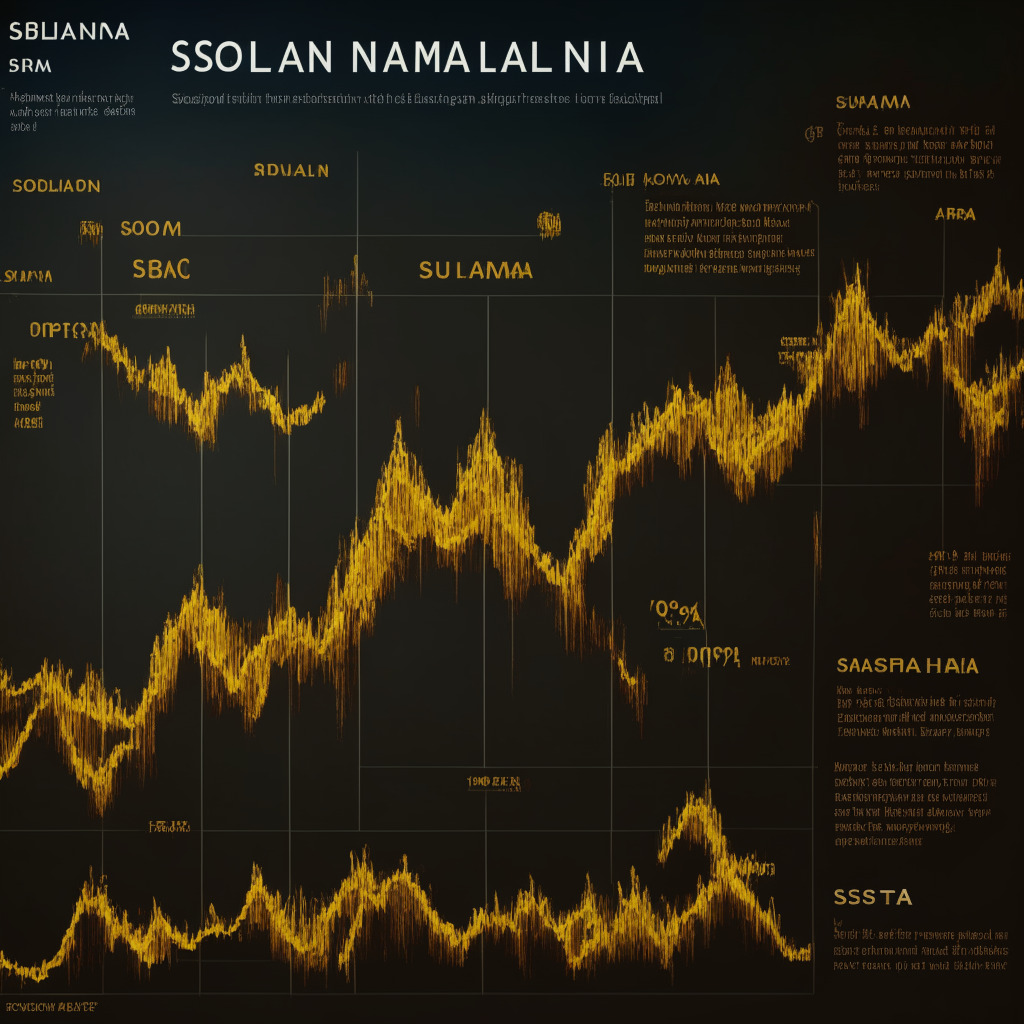

Overcoming the Falling Wedge: Solana Breakout Signals Bullish Takeover and Recovery Rally

Amid the recent correction in the crypto market, Solana’s falling price forms a falling wedge pattern, indicating a decrease in bearish momentum. A bullish breakout from this pattern could signal the end of the prevailing correction phase or the beginning of a new recovery rally, with potential growth up to 26%. Market research before investing is crucial.

XRP Price Recovery: Analyzing Breakout Signals and Potential 25% Rally

The XRP price correction phase might end soon, as recent market data shows early signs of recovery, with a breakout from the falling channel pattern. Increased momentum suggests confident buyers who could drive the price higher and reclaim lost ground. However, it’s crucial to conduct thorough market research before investing in cryptocurrencies due to rapid market changes.

Bitcoin’s $27,500 Test: Double Bottom Pattern vs. Resistance Trendline Battle

Bitcoin’s recent significant upwards momentum, marked by four consecutive green candles and a double bottom pattern, could soon test the $27,500 level. As it bounces off the $26,000 psychological support level, the cryptocurrency’s price could potentially break the immediate resistance to continue the bullish upswing, with technical indicators pointing to possible bullish price action.

Ethereum’s Bullish Reversal Pattern: Analyzing the Potential Rise and Fall

The Ethereum price recently experienced a 1.67% intraday gain, forming a bullish morning star pattern at the $1789 support level. Indicators suggest a potential short gain of 2% towards the $1870 barrier, but a down-sloping trendline threat and increased selling pressure may determine its trajectory. Conduct thorough market research before investing in cryptocurrencies.

Pepecoin Breakout: Reliable Setup or Risky Investment? Analyzing Pros and Cons

Pepecoin’s symmetrical triangle formation indicates reliability for future predictions, as its price respected the pattern despite market volatility. A bullish breakout from $0.000047 resistance shows potential for a 15% rally to reach the overhead resistance trendline at $0.00000175. Technical tools such as EMA and DMI may help forecast market movements. Conduct thorough research before investing in cryptocurrencies.

XRP Price Breakout Signaling Trend Reversal: Analyzing Potential Gains and Ripple Lawsuit Impact

XRP price witnesses a 2.1% jump, potentially breaking the bear’s grip and signaling a trend reversal. A breakout from the channel pattern’s resistance trendline could lead to a swift 5% jump towards the $0.5 mark, provided buyers maintain their position and trading volume provides sufficient confirmation.

Bitcoin Price: Ichimoku Cloud Indicator Predicts Slide to $24,000 – Pros, Cons & Conflicts

Valkyrie Investments’ technical analysis indicates potential further declines in Bitcoin’s value towards $24,000, as the Ichimoku Cloud’s momentum indicator turns bearish. The weakening bullish momentum and possible near-term retrenchment rely on the cryptocurrency’s cloud support and may impact investors’ decisions in the evolving digital currency landscape.

Ethereum’s Price Dilemma: Break Below $1700 or Successful Recovery? Pros, Cons & Future Predictions

The Ethereum price faces a decisive breakdown from the support trendline in the 4-hour timeframe chart, increasing the likelihood of further decline. A bearish crossover between 20-and-50-day EMA or a bullish breakout from the resistance trendline could be key. Before investing in cryptocurrencies, thorough market research is essential.

Ethereum’s Bullish Breakout: Exploring Potential Gains and Resistance Factors

Ethereum price has experienced a tight consolidation recently, forming an ascending triangle pattern. A bullish breakout and crossover from 20 and 50 EMA could attract more buying orders, pushing the price towards $1900. However, a strong resistance trendline could result in a reversal, with a key breakout signal being crucial for bullish growth.

Dogecoin Price Uncertainty: Analyzing the Narrow Trading Range and Potential Breakouts

The Dogecoin price is currently moving sideways within a narrow range between $0.0771 and $0.0698. Traders should watch for a breakout from this range to determine the coin’s potential trend. Indicators suggest a bearish market trend, but selling momentum is weakening.

Ethereum’s Uncertain Future: Analyzing Ascending Triangle and Predicting Breakouts or Breakdowns

Ethereum’s price shows indecisive fluctuations, forming an ascending triangle pattern that could signal potential entry opportunities. A bullish breakout may raise the price by 3%, while a breakdown could extend the retracement phase. The $2000 target remains uncertain, and coin holders should await significant signals before anticipating it.

Falling Wedge Pattern in Solana Price: Temporary Decline or Ominous Trend?

Solana’s price decline due to a falling wedge pattern reflects market uncertainty, but may offer growth potential once completed. The wedge pattern implies a temporary decline before a potential bullish recovery, possibly reaching 30% higher and retesting the $26.1 peak. However, ongoing correction may impact the altcoin’s worth while the pattern remains intact.

Battle between Bitcoin and $27k: Impact on Crypto Market and Top Coins to Watch Now

The cryptocurrency market struggles amidst economic challenges, yet Fed Chair Jerome Powell’s hint at potential rate abatement offers hope. Top cryptos to watch include AiDoge, BGB, $COPIUM, RNDR, ECOTERRA, INJ, and YPRED, offering diverse opportunities based on fundamentals and technical analysis.

Pepecoin Price Downturn: Analyzing the Falling Channel Pattern and Possibilities for Traders

The Pepecoin price experiences a downturn amid market uncertainty, confined within a falling channel pattern that could impact its future and provide trading opportunities. Technical analysis suggests a potential bullish breakout, but traders must stay vigilant as market conditions remain volatile and indecisive.

XRP Price Surge: Recovery Rally on the Horizon or Prolonged Correction Ahead?

XRP price surged 15% recently, reaching the resistance trendline of a falling channel pattern. Increasing trading volume backs the rally, signifying sustained recovery. A breakout may bring back buying pressure, pushing prices 20% higher to the crucial resistance level of $0.55.

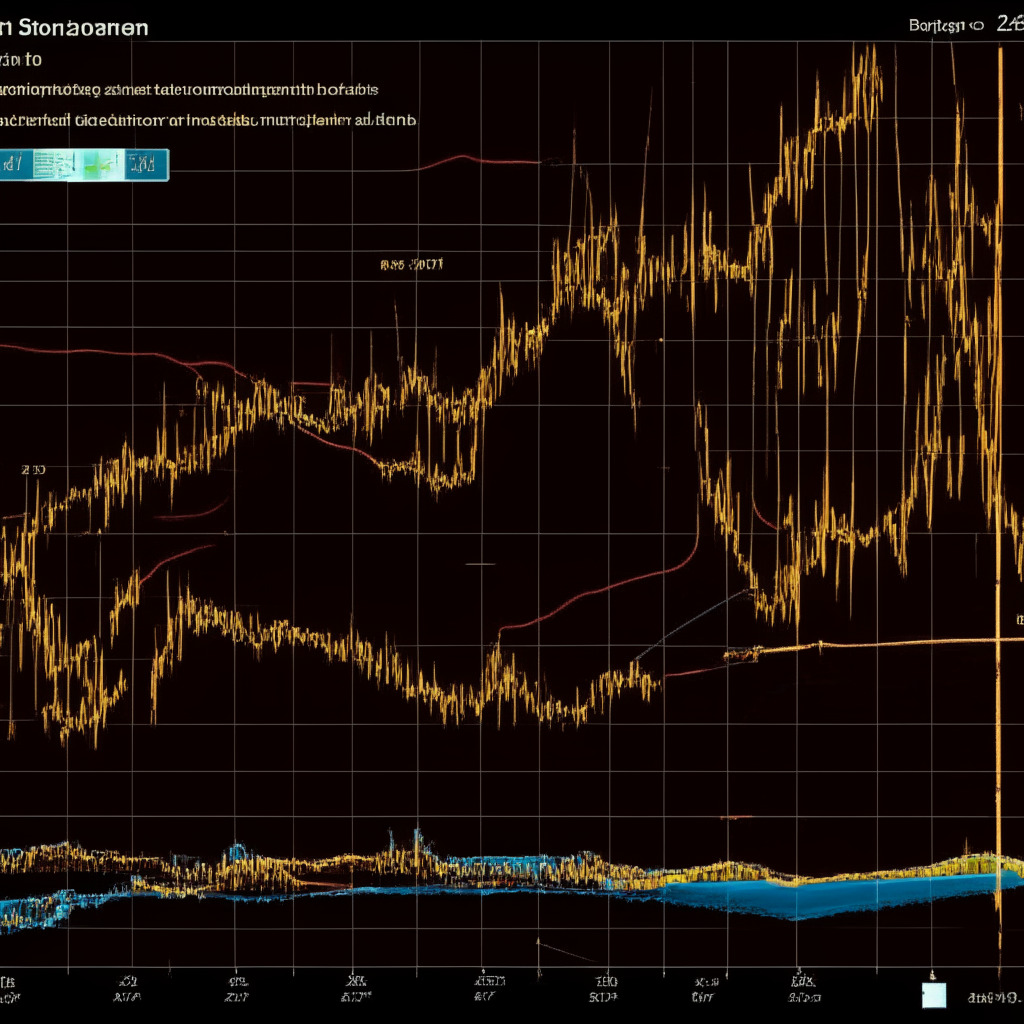

Bitcoin Price: Oscillation Uncertainty, Analyzing the Future Prospects

Bitcoin’s price oscillates between $27,300 and $26,700, reflecting traders’ indecisiveness and a sideways trend. Technical analysis suggests a breakdown below $26,700 could lead to a 5% drop, while a bearish crossover in Exponential Moving Average (EMA) may stimulate more selling orders. The long-term outlook remains bullish, but a downsloping MACD highlights the ongoing downtrend.

Pepecoin’s Inverted Head & Shoulder: Potential Bullish Reversal or Continued Decline?

Pepecoin price faces uncertainty, but a potential bullish reversal pattern known as the inverted head and shoulder could rejuvenate momentum. Key factors include its connection to Elon Musk and breaking the $0.0000021 neckline resistance. Investors must conduct thorough research and stay vigilant in the ever-changing crypto market.

Solana’s Falling Wedge Pattern: Recovery Rally or Extended Correction Ahead?

Solana’s price rebounded from a $19.7 support level, forming a bullish reversal candle pattern that surged the price by 8.5% in four days. Traders are eyeing a potential breakout from the falling wedge pattern’s resistance trendline, indicating a possible recovery rally for the altcoin. Technical indicators like MACD and daily Exponential Moving Averages suggest a strong resistance zone near the resistance trendline.

Bitcoin’s Recovery Rally: Will $27K Support Level Hold or Lead to Lengthier Correction?

Bitcoin’s price fell below $27,000; however, it closed above this support level, showing a 2.5% price increase. The activity suggests a potential upswing in the coming week, with intraday trading volume surging to $13.3 billion, a 44% increase. Nevertheless, Bitcoin’s future remains uncertain, and investors should approach with caution.

Ethereum Price Battle at $1827: Bearish Dive or Bullish Rebound Imminent?

The Ethereum market recently experienced a price breakdown from $1827, signaling a potential extended correction. However, buyers remain active near the 100-day EMA at $1766. Traders should watch for competition between buyers and sellers to determine the coin’s upcoming trend. Bearish momentum could weaken if the buying pressure continues, but a longer correction towards $1600 is also possible.

Pepecoin’s Bullish Reversal: Analyzing the Inverted Head & Shoulder Pattern and Potential Gains

The recent correction in Pepecoin price showcased a bullish reversal, with the market value nearly doubling in two days. The 4-hour chart exhibits a bullish reversal pattern, indicating a potential rally. With sustained buying, the coin price could increase by 8-10%, while a breakout from the trendline could surge the price by an additional 50%. Technical indicators favor a bullish forecast.

Channel Pattern Recovery: ADA’s Potential 40% Growth Opportunity or Breakdown Risk

The Cardano (ADA) price is currently governed by a channel pattern, with a bearish crossover encouraging a sideways move in the short term. A bullish reversal could drive a 40% growth to the $0.5 mark, but a breakdown below the support trendline could result in lower prices. Always conduct thorough research before investing in cryptocurrencies.

Falling Wedge Pattern in Solana Price: Breakout or Prolonged Correction Phase?

Solana price has been in a correction phase, forming a falling wedge pattern. Despite market sell-off, the pattern provides an understanding of possible price movements. A breakout from the wedge pattern could end the correction phase, potentially signaling a 5% price increase in the near term.