The Bitcoin price recently experienced a bearish reversal, with a 5% decline over the week. A breakdown below the $26,500 support level may trigger further drops. Technical indicators, including MACD and EMA, confirm the potential for a downtrend continuation. Caution and research are advised before entering the market.

Search Results for: Slope

XRP’s Battle with $0.55 Resistance: Crucial Hurdle or Gateway to Massive Rally?

XRP price has shown a sustained recovery, surging nearly 30% from its last low to $0.53. It’s gearing up to challenge the multi-month resistance of $0.55, with indicators suggesting bullish trends. However, the responsibility for personal financial loss resides with individual investors, so thorough market research and acknowledging risks are essential before investing in cryptocurrencies.

Inverted Head and Shoulder Pattern: Solana’s Potential 12% Price Jump and Entry Opportunity

The Solana (SOL) price has experienced a sideways trend for almost a month, forming an inverted head and shoulder pattern. With a bullish breakout, a 12% jump in SOL price is possible, supported by factors such as the ADX indicator and 24-hour trading volume. Market participants should prepare for minor pullbacks, retests, and potential trend reversals. Always perform market research before investing in cryptocurrencies.

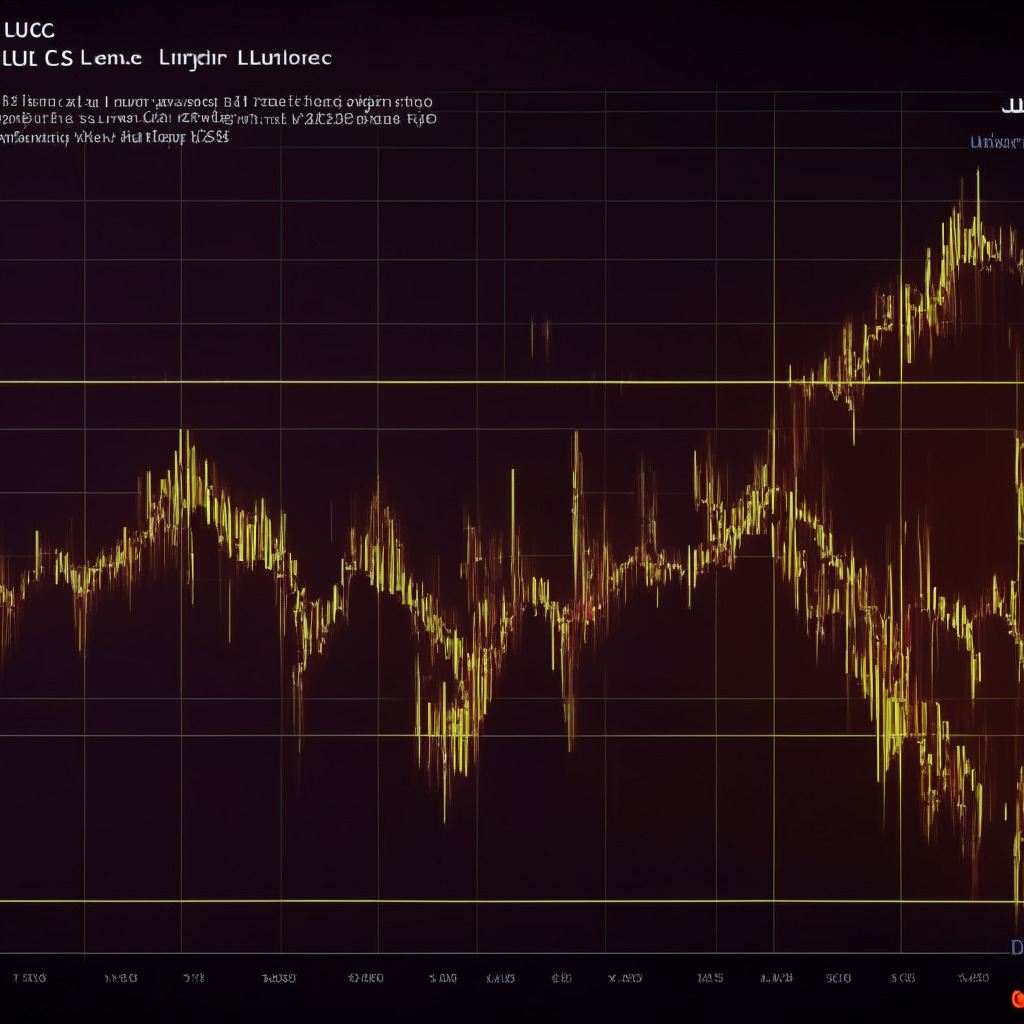

LUNC Breakout: Analyzing Opportunities, Resistance Levels, and Market Risks in Terra Classic

LUNC price breaks above the overhead trendline with an 8% jump, offering buyers an opportunity for a short-term upswing to $0.0001. However, potential challenges like regulatory actions and market volatility may impact LUNC’s price. Exercise caution and conduct thorough market research before investing.

Ethereum Price Recovery: Analyzing Key Resistance Levels and Indicators for Future Growth

Ethereum’s price stands at $1905 with an intraday gain of 0.7%. Buyers face a slight obstacle at the local top of $1922. The recent downturn saw a rebound below the 38.2% Fibonacci retracement level, indicating the overall market trend remains bullish. A breakout above $1922 could lead to a 5.5% rise in Ether’s value. The June 2nd daily green candle is critical for Ethereum’s price, showcasing traits for an upcoming rally.

Ethereum Price Recovery: Can We Expect a $2,000 Milestone Soon? Pros and Cons Examined

Ethereum price formed a bullish morning star candle at a recently breached resistance trendline, suggesting a potential recovery. With market sentiment supporting a bullish recovery and a breakout from the wedge pattern, Ethereum could rise to levels between $2,020 and $2,120. However, uncertainty remains considering the required 30% rally to reach $2,500.

DOGE Price Prediction: Key Decision Point in Falling Channel Pattern Affecting Market Movements

DOGE price displays a falling channel pattern, with ongoing crypto market volatility causing sideways movement between $0.0755 and $0.0692 levels. The current downtrend may breach support, causing a 20% drop. However, buyers accumulating at the channel bottom could potentially trigger a new bull cycle, driving the price back up. Market participants must closely monitor trends and updates for informed decisions.

Billion-Dollar Token Bridge Thefts: Navigating Security in a Multi-Chain Era

2022 saw over $2 billion in token bridge thefts due to vulnerabilities in security measures. This article discusses common security breaches, including social engineering attacks, private key issues, and smart contract vulnerabilities, and highlights how experts are developing stronger security protocols for a secure multi-chain future.

Cardano’s ADA: Battle Between Buyers and Sellers at Key Support Trendline

The Cardano price is demonstrating a rising support trendline within a parallel channel pattern, suggesting buyers are actively accumulating ADA. Despite short-term bearish trends, continuous support could potentially lead to a bullish reversal with a recovery target of $0.42.

Ethereum Price Recovery: Analyzing the Wedge Pattern Breakout and Market Sentiment Shift

Amid the recent crypto market sell-off, Ethereum price witnessed a minor pullback that retested the breached trendline of the wedge pattern, signaling an early sign of the end of the correction phase. The wedge pattern breakout indicates a potential recovery rally with a target of $2000, as the market sentiment shifts from selling to buying. However, investors should remain cautious and monitor factors driving the Ethereum price.

Pepecoin Breakdown: Analyzing Its Potential Downtrend and Resistance Challenges

The Pepecoin price experienced a decisive breakdown from the support trendline of the inverted pennant pattern on May 30th, potentially facing a significant downfall. Currently trading at $0.00000127, the coin is expected to retest the broken support as potential resistance to assess price sustainability at lower levels. A bearish pennant pattern could amplify the momentum, leading to a temporary break in the sideways trend.

Bullish Patterns in Cardano, Solana, and Uniswap: Analyzing Market Entry Opportunities

This article discusses the bullish patterns in Cardano, Solana, and Uniswap which could potentially trigger significant price upswings. However, the author advises caution and thorough market research before investing, as market conditions remain uncertain and volatile.

Bitcoin’s Downturn: Analyzing the Channel Pattern and Potential Collapse Below $26,000

The Bitcoin price saw a downturn on May 29th, suggesting a corrective path with a possible drop below $26,000. Increased selling pressure during price rallies and bearish market sentiment contribute to this outlook. Watch for impacts on Bitcoin’s future trend and always conduct thorough market research before investing.

Ethereum Price Struggles: False Breakout or Recovery Path? Examining Market Trends and Risks

A notable increase in the crypto market on May 28th allowed Ethereum to surpass a descending resistance trendline, indicative of buyers regaining control. However, struggles to maintain above the breached trendline raise concerns about a false breakout scenario and potential decline in Ethereum price.

Frog-Themed Memecoin PEPE’s Troubling Decline: A Sign of Memecoin Instability?

The frog-themed memecoin, PEPE, experiences a price decline for three consecutive days, raising concerns about its future. The breakdown below the symmetrical triangle pattern and Exponential Moving Average indicates a bearish trend, questioning the stability of memecoins in general. Conduct thorough market research before investing.

Shiba Inu Price Stagnation: Analyzing Market Sentiment and Looming Breakout Possibilities

Shiba Inu coin’s price stagnation and ongoing consolidation phase present both opportunities and challenges for investors. Growing bullish momentum and support trendline offer hope for a trend reversal, but lack of clear direction emphasizes the need for caution in decision-making.

LUNC Price Consolidation: Potential Breakout Scenarios and Impacts on Terra Classic

The LUNC price of Terra Classic coin is in a consolidation phase with potential for either side breakout. Two primary scenarios include a downtrend due to wedge pattern influence, or a bullish recovery if the price breaks through resistance trendline. Market volatility and technical indicators impact the outcome.

Bitcoin Recovery Rally: Overcoming Key Resistance or Prolonged Correction Ahead?

The Bitcoin price struggles to surpass immediate resistance as the falling channel pattern continues to keep it under threat for prolonged correction. A breakout above the overhead trending line could trigger a fresh recovery rally, while a breakdown below $27,300 may resume ongoing correction. Personal research and understanding of market conditions remain crucial before investing in cryptocurrencies.

Cardano Price Recovery: Analyzing a Potential Surge to $0.5 Amid Market Uncertainty

The Cardano price experienced a bullish reversal within the channel pattern, and a breakout above the $0.378 barrier could continue its recovery rally. As buying momentum persists, the reversal may push prices towards the $0.5 mark, but investors should remain cautious of resistance levels and market conditions to ensure sustainable long positions.

Ethereum Breakout Signals Potential Trend Reversal: Analyzing Market Conditions & Resistance Levels

Ethereum recently experienced a price breakout on May 28th, signaling a potential trend reversal. With a high volume of buyers, Ethereum’s market value could climb 12.2% to hit $2132. However, investors must vigilantly observe market conditions as resistance levels remain crucial to maximize success in the volatile market.

XRP Price Recovery: Analyzing Breakout Signals and Potential 25% Rally

The XRP price correction phase might end soon, as recent market data shows early signs of recovery, with a breakout from the falling channel pattern. Increased momentum suggests confident buyers who could drive the price higher and reclaim lost ground. However, it’s crucial to conduct thorough market research before investing in cryptocurrencies due to rapid market changes.

Ethereum’s Bullish Reversal Pattern: Analyzing the Potential Rise and Fall

The Ethereum price recently experienced a 1.67% intraday gain, forming a bullish morning star pattern at the $1789 support level. Indicators suggest a potential short gain of 2% towards the $1870 barrier, but a down-sloping trendline threat and increased selling pressure may determine its trajectory. Conduct thorough market research before investing in cryptocurrencies.

Analyzing LUNC Price Patterns and Implications Amid Terra Classic Token Burn

The Terra Classic coin LUNC displays a double-bottom pattern, indicating potential bullish recovery. Currently trading at $0.0000863, its price may surge 8.8% to challenge the neckline resistance of $0.000094. A successful breakout could lead to a 12% rise in market value, while overcoming downsloping trendline resistance signals a sustained recovery in Terra coin.

Pepecoin Breakout: Reliable Setup or Risky Investment? Analyzing Pros and Cons

Pepecoin’s symmetrical triangle formation indicates reliability for future predictions, as its price respected the pattern despite market volatility. A bullish breakout from $0.000047 resistance shows potential for a 15% rally to reach the overhead resistance trendline at $0.00000175. Technical tools such as EMA and DMI may help forecast market movements. Conduct thorough research before investing in cryptocurrencies.

Double-Bottom Pattern Formation: Will Bitcoin Break $27.5k Neckline Resistance?

Bitcoin’s price has formed a double-bottom pattern at the $26,000 support level, indicating a potential bullish reversal. A breakthrough above the $27,500 neckline resistance is crucial for demonstrating buying momentum. Despite optimistic factors, market unpredictability requires traders to conduct thorough research and adapt to new developments.

The Orb: Unveiling Worldcoin’s Controversial Iris Scanning Crypto Project

OpenAI CEO Sam Altman’s Worldcoin project aims to create a global ID, currency, and a crypto payment app, raising concerns and skepticism over its biometric data requirement. With The Orb as its central tool, Worldcoin recently raised $115 million in Series C round, garnering investor enthusiasm despite the concerns.

XRP Price Breakout Signaling Trend Reversal: Analyzing Potential Gains and Ripple Lawsuit Impact

XRP price witnesses a 2.1% jump, potentially breaking the bear’s grip and signaling a trend reversal. A breakout from the channel pattern’s resistance trendline could lead to a swift 5% jump towards the $0.5 mark, provided buyers maintain their position and trading volume provides sufficient confirmation.

Bitcoin’s Sideways Trend: Debating Breakout Potential and Bearish Risks

Bitcoin price remains in a sideways trend, with range restricted between $27,500 and $26,000. Traders await a clear breakout before entering the market, while the short-term trend appears bearish, pointing towards downside potential. Market overview suggests prevailing bearish trend; caution is advised.

Bearish Pennant Pattern in Filecoin: Impact on Future Trends and Investment Strategies

The bearish pennant pattern formation in Filecoin’s 4-hour time frame chart signals a potential 12% downfall, with demand pressure at $4.2, $4, and $3.55. Amidst an indecisive trend for Bitcoin, Filecoin’s price is consolidating within converging trendlines, possibly leading to further selling momentum. This article serves as an educated forecast based on technical analysis; always perform market research before investing in cryptocurrencies.

Ethereum’s Price Dilemma: Break Below $1700 or Successful Recovery? Pros, Cons & Future Predictions

The Ethereum price faces a decisive breakdown from the support trendline in the 4-hour timeframe chart, increasing the likelihood of further decline. A bearish crossover between 20-and-50-day EMA or a bullish breakout from the resistance trendline could be key. Before investing in cryptocurrencies, thorough market research is essential.

3 Factors Driving Shiba Inu’s Potential Bullish Momentum: Chart Patterns, Consolidation, and RSI

Recent market movements suggest Shiba Inu (SHIB) may be gaining momentum, driven by a symmetrical triangle pattern, a short-term consolidation phase above a support trendline, and a bullish Relative Strength Index (RSI). A potential breakout could signal a trend reversal and higher price targets.

Ethereum’s Bullish Breakout: Exploring Potential Gains and Resistance Factors

Ethereum price has experienced a tight consolidation recently, forming an ascending triangle pattern. A bullish breakout and crossover from 20 and 50 EMA could attract more buying orders, pushing the price towards $1900. However, a strong resistance trendline could result in a reversal, with a key breakout signal being crucial for bullish growth.