The Terra Classic (LUNC) price has dropped 58.3% since its peak, now valued at $0.000087. As the market grapples with uncertainty, the outcome of LUNC’s confrontation with dynamic resistance will determine its future correction or recovery rally.

Search Results for: Slope

Dogecoin Price Uncertainty: Analyzing the Narrow Trading Range and Potential Breakouts

The Dogecoin price is currently moving sideways within a narrow range between $0.0771 and $0.0698. Traders should watch for a breakout from this range to determine the coin’s potential trend. Indicators suggest a bearish market trend, but selling momentum is weakening.

Shiba Inu’s Struggle for Price Recovery: Can it Regain Bullish Momentum?

Shiba Inu price breaks out from a two-week-long resistance trendline, setting up for a potential 14% rise. However, it faces a significant obstacle at the $0.00000917 mark. The rising RSI slope and reclaimed EMAs indicate increasing buying pressure and potential growth, but negative market sentiment could delay progress.

Ethereum Consensus: Balancing Validator Roles and Security Risks Beyond the Merge

Ethereum co-founder Vitalik Buterin cautioned against extending Ethereum’s consensus beyond essential functions like validating blocks and securing the network. He highlighted that expanding consensus “duties” increases costs, complexities, and risks, potentially exposing the ecosystem to security vulnerabilities or 51% attacks. Buterin advocated for a minimalistic approach and assisting developers in finding alternative security methods.

Pepecoin’s Struggle to Break Resistance: Analyzing Upside and Downside Potential

Pepecoin, the frog-themed memecoin, faces significant selling pressure amidst market uncertainty. Despite an 11% intraday growth on May 20th, the resistance trendline remains unbreached, indicating sellers’ ongoing defense. With Pepecoin trading at $0.00000173, a sideways move between resistance and $0.0000016 support is likely. However, a breakout from overhead resistance could initiate a recovery cycle.

Symmetrical Triangle Pattern: Predicting Bitcoin’s Breakout and Implications for Traders

Bitcoin’s price has been demonstrating a sideways trend in recent weeks, forming a symmetrical triangle pattern. As the price spread tightens, a breakout point is approaching, potentially aiding buyers in regaining buying pressure. Technical indicators reveal traders’ hesitancy, but a post-breakout rally could elevate the Bitcoin price by 5-6%.

SingularityNET Coin: Analyzing the Falling Channel Pattern and Potential Reversal

SingularityNET coin (AGIX) experienced a 49.7% drop from its peak price, influenced by a falling channel pattern. A bullish retracement could signal a downtrend continuation. The 24-hour trading volume for AGIX reflects a 223% gain at $402.2 million. Technical indicators may help predict potential market movements and trend reversals.

Cardano Price Sideways Movement: Accumulation Sign or Bearish Omen?

Cardano price experiences sideways movement, staying above the support trendline, suggesting active accumulation and potential bullish reversal. The ADA price could surge, breaching $0.38 resistance, while technical indicators show increased buying momentum. Investors should monitor market conditions and research before decisions.

Shiba Inu Price Uncertainty: Analyzing Triangle Patterns and Breakout Possibilities

The Shiba Inu price is confined within a symmetrical triangle pattern, reflecting market indecisiveness. A breakout point could be imminent, either resuming the bearish trend or reviving bullish momentum. Investors should conduct comprehensive research before participating in crypto investments.

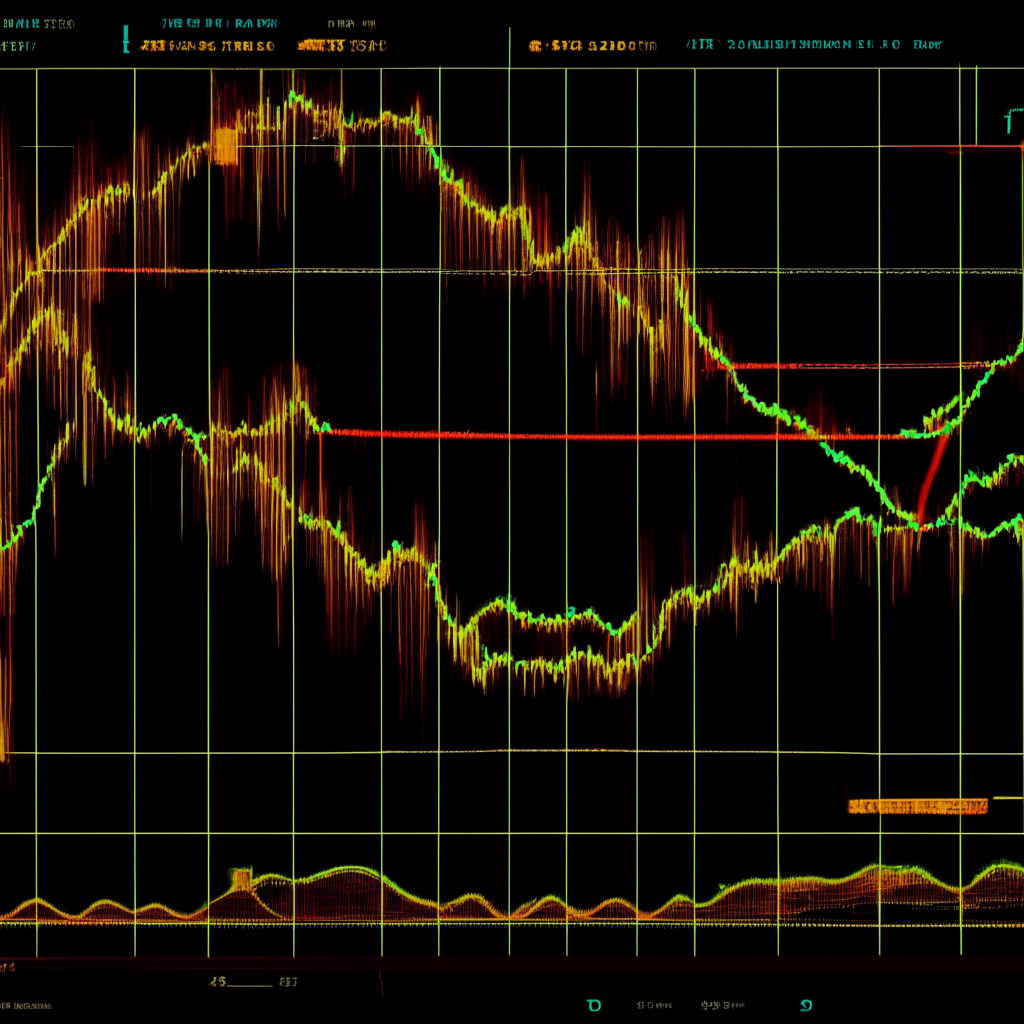

XRP Price Surge: Recovery Rally on the Horizon or Prolonged Correction Ahead?

XRP price surged 15% recently, reaching the resistance trendline of a falling channel pattern. Increasing trading volume backs the rally, signifying sustained recovery. A breakout may bring back buying pressure, pushing prices 20% higher to the crucial resistance level of $0.55.

Bitcoin Price Stability: Analyzing Market Behavior and Predicting Future Movements

The Bitcoin price is hovering above the $27,000-$26,780 support, reflecting indecisiveness among market participants. Despite this consolidation, BTC’s price reversal and strong support from $27,000 suggest a potential rally surging prices 7% higher. However, a breakout above the resistance trendline is needed to kickstart a new recovery rally.

Shiba Inu Price Breakdown: Analyzing the Triangle Pattern & Potential 10% Decline

The Shiba Inu price has been trading sideways, forming a symmetrical triangle pattern. A surge in selling pressure led to a bearish breakdown, with sellers regaining control. Despite a 20% increase in intraday trading volume, the SHIB price faces potential declines and mounting negativity in technical indicators.

Bitcoin Price: Oscillation Uncertainty, Analyzing the Future Prospects

Bitcoin’s price oscillates between $27,300 and $26,700, reflecting traders’ indecisiveness and a sideways trend. Technical analysis suggests a breakdown below $26,700 could lead to a 5% drop, while a bearish crossover in Exponential Moving Average (EMA) may stimulate more selling orders. The long-term outlook remains bullish, but a downsloping MACD highlights the ongoing downtrend.

Cardano’s Bullish Breakout: Analyzing Recovery Opportunities Amid Market Uncertainty

Cardano’s price recovery opportunity emerges as ADA breached the overhead trendline, with a bullish breakout from the $0.376 resistance. Strong support, resistance trendline breakout, and a potential break above $0.37 indicate a possible 30-35% rally in the coming months, targeting the $0.49-$0.5 price range.

SUI Double Bottom Pattern Emergence: A Bullish Breakout or Another Awaiting Pullback?

The SUI coin price rebounded twice at the $1.02 level and surged 22% within three days, hinting at a double bottom bullish reversal pattern. A breakout from $1.26 with increasing buying pressure could push prices up to $1.47, while technical indicators suggest a bullish recovery. Conduct thorough market research before investing in cryptocurrencies.

Dogecoin’s Price Recovery: Analyzing Bullish Reversal Pattern & Market Uncertainty

The DOGE price might see a bullish upswing in the upcoming week with several lower price rejections at the support level of $0.071. Technical indicators, such as the 4-hour Relative Strength Index, suggest potential bullish movement, raising the possibility of an upswing towards the overhead trendline.

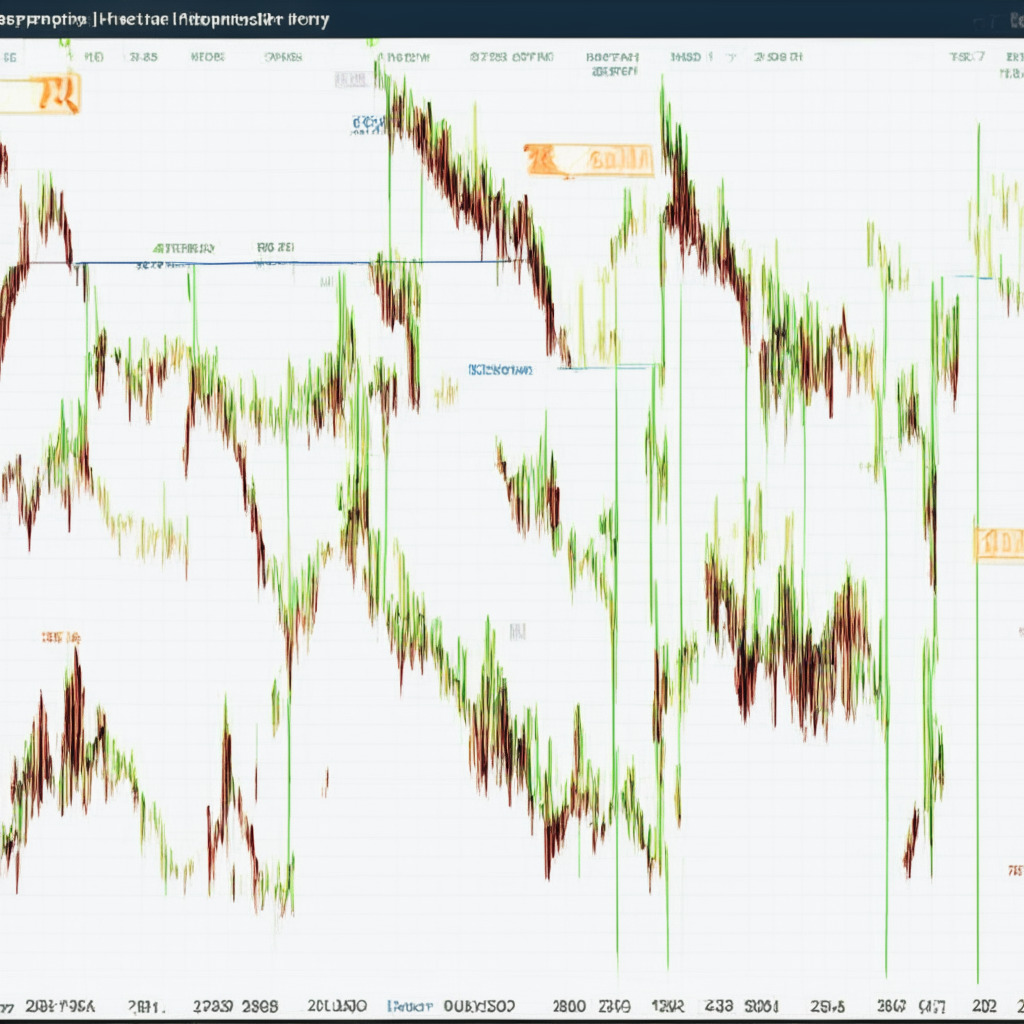

XRP’s Ascending Triangle Pattern: A Glimmer of Hope or Prolonged Correction?

XRP has been trading sideways, consolidating between $0.433 and $0.408, showcasing uncertainty surrounding the coin. However, examining the shorter time frame chart reveals the formation of a bullish ascending triangle pattern, signaling a potential upswing. The rising support trendline is expected to push the price higher, potentially clearing the neckline resistance of $0.44.

Ethereum Price Battle at $1827: Bearish Dive or Bullish Rebound Imminent?

The Ethereum market recently experienced a price breakdown from $1827, signaling a potential extended correction. However, buyers remain active near the 100-day EMA at $1766. Traders should watch for competition between buyers and sellers to determine the coin’s upcoming trend. Bearish momentum could weaken if the buying pressure continues, but a longer correction towards $1600 is also possible.

Bitcoin’s $27,000 Support Defense: Bullish Reversal or Temporary Hold? Pros, Cons & Main Conflict

Bitcoin price showed a breakdown attempt from the monthly support of $27,000-$26,786 on May 12th, but buyers defended the support, suggesting a possible bullish reversal. The current correction phase is governed by a resistance trendline, with Bitcoin trading at $26,874 and an intraday loss of 0.12%. A breakout could signify uptrend resumption and re-challenge the $31,000 peak.

Pepecoin’s Bullish Reversal: Analyzing the Inverted Head & Shoulder Pattern and Potential Gains

The recent correction in Pepecoin price showcased a bullish reversal, with the market value nearly doubling in two days. The 4-hour chart exhibits a bullish reversal pattern, indicating a potential rally. With sustained buying, the coin price could increase by 8-10%, while a breakout from the trendline could surge the price by an additional 50%. Technical indicators favor a bullish forecast.

Dogecoin’s Falling Wedge Pattern: Potential for a 47.8% Rally Amid Market Downturn

Dogecoin (DOGE) price experienced a sharp 31.6% correction, from $0.105 to $0.07, following a falling wedge pattern. A bullish breakout could potentially trigger a 47.8% rally, but the ongoing correction is expected to persist. Strong bearish momentum is evident in technical indicators.

Falling Wedge Pattern in Solana Price: Breakout or Prolonged Correction Phase?

Solana price has been in a correction phase, forming a falling wedge pattern. Despite market sell-off, the pattern provides an understanding of possible price movements. A breakout from the wedge pattern could end the correction phase, potentially signaling a 5% price increase in the near term.

Ethereum Price Breakdown: Temporary Pullback or Start of a Major Downtrend?

Ethereum experienced a breakdown from support levels of $1,827, leading to increased selling momentum. Despite falling for seven consecutive days, the overall trend remains bullish. Ethereum trades at $1,766 with potential to hit $1,500 or rebound from the long-support trendline, offering pullback trade opportunities.

Bitcoin’s Downtrend: Will the Support Trendline Save the Day?

Amidst Bitcoin’s downward trend with an 11.3% weekly loss, it breached the $27,000 support, signaling a potential extended downward period. Despite this decline, the overall market remains supportive of a potential bullish rally as long as the rising support trendline remains intact.

Pepecoin Plummets: Will It Survive the Market Downturn or Collapse Further?

Pepecoin price has plummeted 68.5% from its all-time high, indicating potential for further decline. A breakdown below $0.0000014 could result in a 39% downfall, with bearish crossovers and intense selling momentum affecting the market. Investors should conduct thorough research before investing.

XRP

The falling XRP price has found support at $0.42, creating a strong accumulation zone alongside other technical levels. With long tail rejection candles at this support, there is a higher possibility of a price rally. The current correction phase is steered by a falling channel pattern, indicating a potential bullish reversal and an 8% rise if it breaks the overhead resistance trendline.

SUI Price: Fake Breakdown, Bullish Breakout, and the Impact of US CPI Inflation

The SUI price experienced a fake breakdown below $1.17, but reclaimed this level as support after the U.S. CPI inflation came in lower than expected. This bullish breakout offers a potential long-entry opportunity as the crypto market responds to external factors. Investors must remain cautious and conduct diligent research.

Pepecoin Correction: A Buying Opportunity or Extended Decline? Analyzing the Bullish Scenario

Pepecoin experiences a 57.2% drop in value, currently in a correction phase. The decline, however, may entice investors to buy at a lower price. The emergence of an ascending triangle pattern could mark the beginning of a new bullish recovery.

Bearish Breakdown in Cardano Coin Price: Short-Selling Opportunities and Resistance Levels

The Cardano coin price experienced a bearish breakdown, plunging 3.5% to $0.367 due to rising selling pressure in the cryptocurrency market. A potential rally could face multiple resistance levels, while the daily Relative Strength Index indicates high bearish momentum. Traders may be able to take advantage of short-selling opportunities with this pattern.

XRP Price Analysis: Bullish Continuation Pattern Amid Selling Pressure – A Reversal or Trap?

The XRP price has plunged to a support trendline of a bullish ‘Flag’ pattern, indicating potential accumulation and reversal. However, skepticism remains, as market moves are unpredictable. Investors should approach predictions cautiously and conduct their own market research before investing in cryptocurrencies.

Stacks Coin Price: Navigating Between Resistance Trendline and $0.67 Support – What’s Next?

The Stacks coin price is currently trading at $0.76, oscillating between a downsloping resistance trendline and $0.67 support in a narrow range. As the price converges to a single point, a decisive breakout is anticipated. Overall market sentiment remains bullish, but caution is advised.

Solana’s Bullish Flag Pattern: A Prelude to Massive Rally or Sideways Movement?

Solana’s price has been in a sideways movement for four months, forming a bullish flag pattern that could trigger a significant uptrend upon breaking through its resistance trendline. Traders await a breakout to witness a sustained rally, with a potential price target of $40.